Real-time transaction-based reporting and pre-clearance of Value-Added Tax invoices to tax authorities to improve tax collections and simplify compliance

Governments seize control of invoicing process

As governments around the world look to close the Value-Added-Tax (VAT) Gap – missed VAT or GST tax collections – many are turning to mandated live invoice reporting and validation. .This is commonly termed Continuous Transaction Controls (CTC) or transaction-based reporting. It comes in a number of forms, including e-invoices or transaction list reporting. And most countries now impose validation checks and cross-checking to customer records (in real-time) before invoices are issued – meaning the issuer has surrendered CTC is offering opportunities to simplify compliance further along the reporting chain, including removal of VAT return obligations.

The trend started in South America, with pioneers such as Chile and Mexico, and now is spread to Europe and Asia. The EU is evaluating its own version of Digital Reporting Requirements, but faces challenges with a proliferation of standards already.

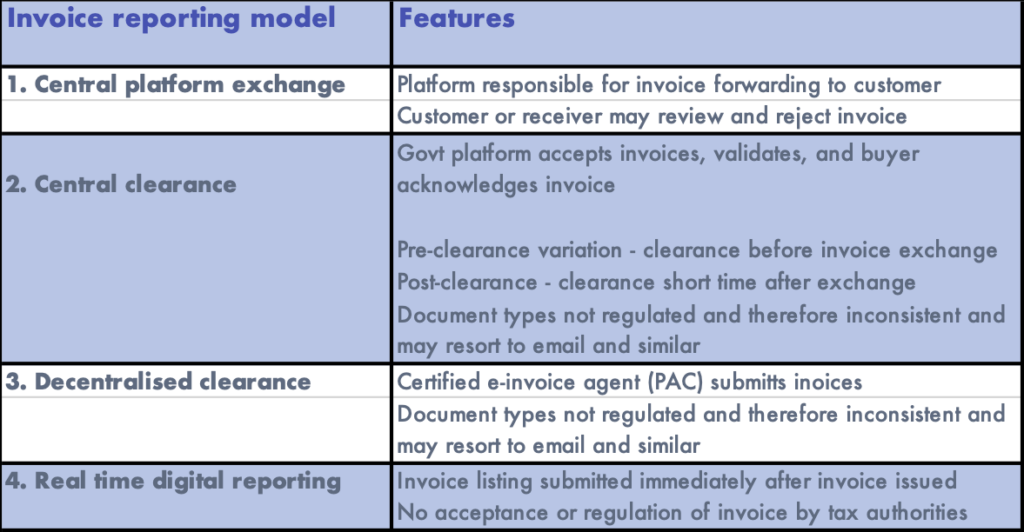

CTC e-invoicing and real-time models

Common features of Continuous Transaction Controls (CTC)

- Reporting of invoices to the tax authorities:

- Invoice data is transmitted to the authorities interface or portal:

- Automatically via API or similar from invoice issuer’s ERP, accounting, invoice, e-commerce platform, point-of-sale or similar system;

- Manual upload of listings

- Manual invoice-by-invoice creation in portal; or

- Via approved invoice agent

- Typically, in real-time or within a few days of the creation of the invoice

- Most tax authorities impose basic invoice validation checks, in real time, and will return a approve, errors or reject message to the issuer

- Increasingly, the country platforms will also transmit the validated invoice to the customer of the invoice issuer, and only at this point will the invoice be considered legally issued from a VAT perspective. Many countries are becoming increasing sophisticated at enabling customer to review, reject or approve the invoices online in full invoice exchange platforms. This can also include cross-checking of sellers and purchasers invoices and book-keeping.

- The standardisation of these platforms has been variable. The European Commission is pursuing some harmonisation (see below) following on from its work on the core invoice standarisation. But many countries have already launched their own systems which will present challenges for interoperability.

- Data from such centralised systems are now being used to prepare pre-filled draft VAT returns which taxpayers can then review, adjust and approve. Thus simplifying the VAT compliance process for both the taxpayer and tax authorities.